- For Tech Startups & SaaS Companies

Access the Top 1% of Fractional CFOs for Tech Startups — Powered by Alpyne

Scale faster, raise smarter, and optimize cash flow with CFOs who use Alpyne’s real-time financial intelligence.

Why Tech Startups Struggle Without a Fractional CFO

Early-stage and growth-stage tech startups often operate in “financial fog,” making decisions based on gut instinct rather than data. Common challenges include:

Unclear Cash Runway

Founders struggle to forecast 13-week cash flow across multiple products and channels.

Investor-Readiness Gaps

Series A/B startups lack clean financial models, cohort analyses, and investor-ready dashboards.

Unit Economics Uncertainty

SaaS startups need to track MRR, LTV:CAC, churn, and expansion metrics accurately.

Scaling Bottlenecks

Internal accounting systems can't keep up with rapid user growth or subscription expansion.

Why Alpyne-Powered Fractional CFOs Outperform Traditional Consultants

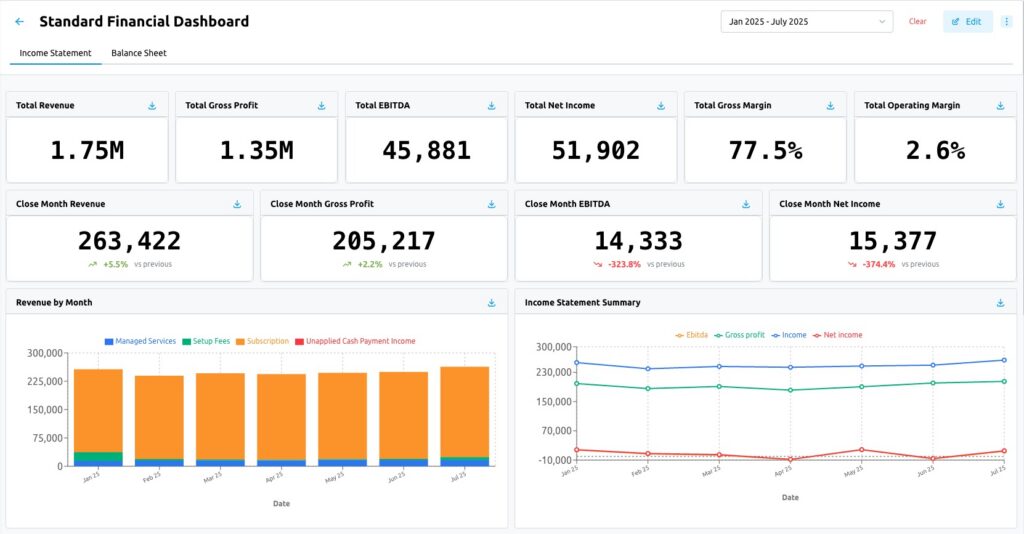

Alpyne CFOs utilize automation and integrated data intelligence to deliver faster, more strategic results.

Automated Financial Modeling

Connects Stripe, HubSpot, QuickBooks, and Salesforce to provide a single source of truth.

Real-Time Metrics

Track MRR, ARR, churn, LTV:CAC, and retention cohorts automatically.

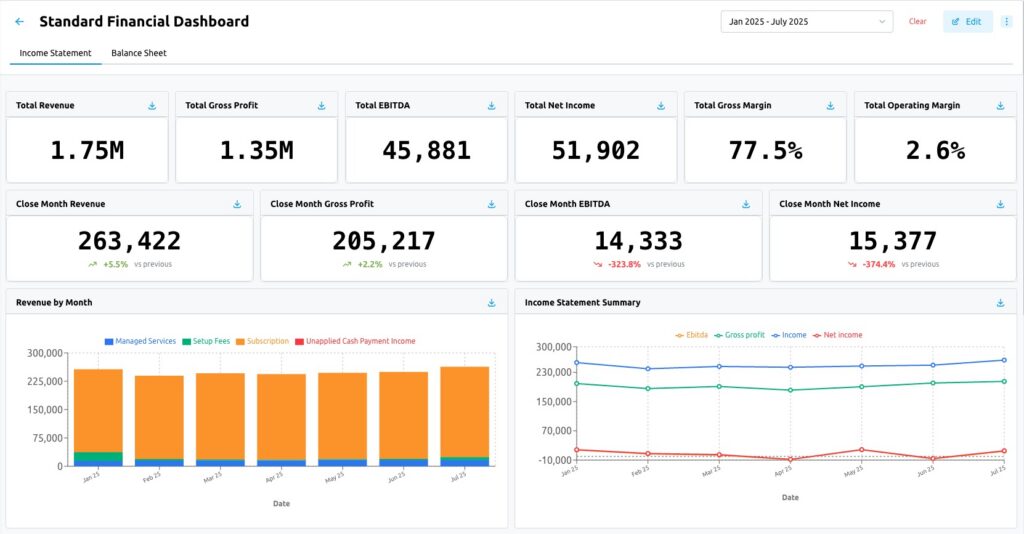

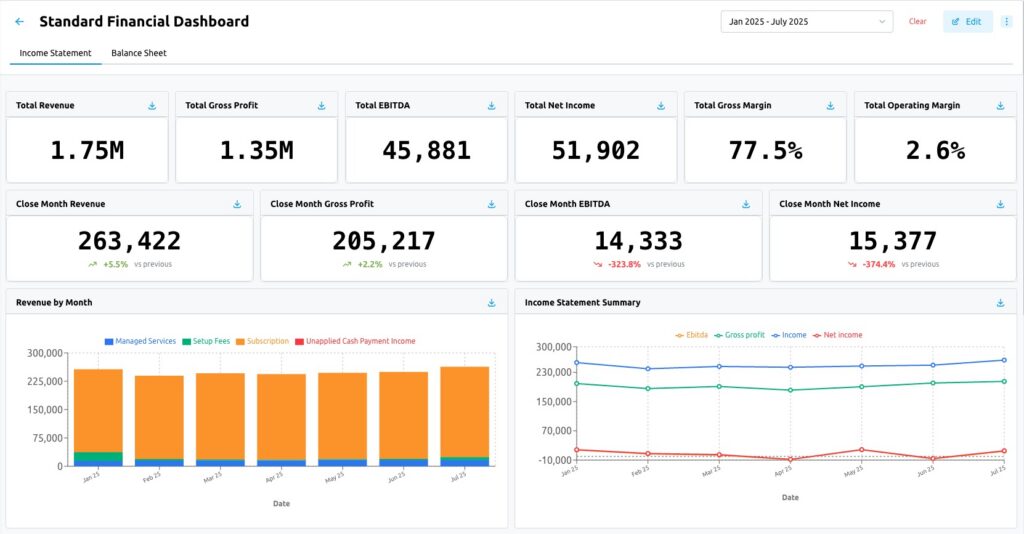

Investor-Ready Reports

Build clean, board-ready dashboards in minutes instead of weeks.

Investor-Ready Reports

Build clean, board-ready dashboards in minutes instead of weeks.

Fractional CFO Expertise by Industry

Specialized financial leadership tailored to your industry’s unique challenges

SaaS / Subscription

Key Metrics: MRR, ARR, LTV:CAC, Churn

Automated cohort analysis, expansion tracking, predictive retention modeling

- Real-time MRR and ARR tracking across all subscription tiers

- Automatic churn prediction with early warning alerts

- LTV:CAC optimization recommendations

- Net revenue retention analysis by cohort

Fintech

Key Metrics: Burn rate, runway, CAC

Real-time cash flow forecasting, scenario analysis, investor-ready dashboards

- 13-week rolling cash flow forecasts

- Multiple scenario modeling for fundraising

- CAC payback period tracking

- Regulatory compliance-ready reporting

Marketplace

Key Metrics: GMV, take rate, unit economics

Automated margin analysis, SKU-level profitability, trend alerts

- GMV and take rate optimization insights

- Seller/buyer cohort analysis

- Transaction-level profitability tracking

- Supply/demand forecasting

Tech Startups Who Scaled with Alpyne CFOs

See what leaders say about working with Alpyne-powered CFOs

Trusted by Startups in

Start with a Pilot Engagement

To remove risk and demonstrate immediate value, we offer flexible engagement options for tech startups.

The Diagnostic

$2,500 – $5,000

2-week deep dive. CFO uses Alpyne to audit financial health and provide a roadmap.

Most Popular

The Project

Custom

Deliverables like investor-ready models, 13-week cash flow forecasts, or unit economics analysis.

Ongoing Retainer

Monthly

Transition to a full strategic partnership once value is proven.

- For Tech Startups

Get Your Fractional CFO Today

Connect with an Alpyne-powered CFO and start making data-driven decisions immediately.

- Free 30-minute consultation

- Same-week onboarding available

- No long-term commitment required